Judge Rejects SAD Scheme Joinder–Toyota v. Schedule A Defendants

Toyota brought a SAD Scheme case against 103 defendants before Judge Daniel in the Northern District of Illinois. (Seriously, Toyota? Using abusive IP enforcement tactics? Do better). As I recently mentioned, Judge Daniel is calling out overreaching joinder allegations in SAD Scheme cases. Here, he gave Toyota a chance to justify their joinder. It doesn’t go well for Toyota–or for other rightsowners cutting due process corners.

The opinion recounts Toyota’s purported bases for joinder:

According to the plaintiff, joinder is proper because: (1) it allows the plaintiff to combat the unique problem of offshore Internet-based counterfeiters who exploit the anonymity and mass reach afforded by the Internet; (2) the defendants all fit the same profile, working in a similar manner and during the same time period to sell counterfeit products as part of the same occurrence or series of occurrences; (3) district courts have broad discretion to evaluate joinder as the case progresses, so they should just allow joinder and adjust as needed; (4) some counterfeiters coordinate actions to evade detection and liability, so district courts should infer that all counterfeiters, including the defendants named here, coordinate actions to evade detection and liability; (5) some counterfeiters use the same wording in product descriptions, so district courts should infer that the use of the same wording means that all of the defendants are in league with each other; and (6) some Seller Aliases may have common ownership, so district courts should allow joinder because the plaintiff does not have access to the information necessary to show common ownership at this time.

If these justifications sound familiar, it’s because these are the generic rotely-made defendant-unspecific allegations that are copied and pasted into most SAD Scheme complaints. Judge Daniel responds unambiguously: “None of these arguments are persuasive.”

Toyota cited the 2020 Bose decision, which said that online marketplace alleged counterfeiters could be analogized to BitTorrent infringers, where courts have held that joinder against BitTorrent participants can be supported when they are all part of the same swarm. SAD Scheme plaintiffs love this “swarm” theory because it alleviates their need to connect the dots between defendants–joinder can be based on defendant-unspecific vibes, like “infringement is generally in the air/water.” Judge Daniel calls out the swarm theory:

- The Bose ruling isn’t binding precedent.

- A BitTorrent swarm is factually distinguishable from SAD Scheme defendants, where the defendants “have no shared purpose.”

- Alleged commonalities in the defendants’ practices (nondescript alias, foreign operations, no physical address, “similar advertising, marketing strategies, and techniques”) do “not link the defendants to the same transaction, occurrence, or series of transactions or occurrences” as required by FRCP 20.

I describe this situation as “parallel” infringements. Independent defendants are allegedly infringing independently in parallel with each other. That doesn’t mean they are coordinating their actions in any way that FRCP 20 recognizes. Yet, the swarm theory has allowed courts to dodge this obvious conclusion.

With respect to the last bullet, Judge Daniel explained how offline infringers routinely independently adopt common sales techniques and offer similar or identical merchandise at high-traffic sales locations, like right outside a sporting venue before a game. The merchants may “swarm” customers, but there is no “logical relationship” between these merchants.

The judge invokes an analogy to hub-and-spoke conspiracies, where there must be some “rim” along the wheel connecting the spokes to each other. The “rim” is apparent in BitTorrent swarms–the participants are all processing the same file. In contrast, “Nothing like that exists here. There is no series of occurrences to trace back to a common hub or shared purpose.”

Here, Toyota conceded that “not every defendant is working with other defendants.” In other words, Toyota admits that these are parallel alleged infringements. Nevertheless, Toyota argued that “some counterfeiters coordinate actions to evade detection and liability, some counterfeiters use the same wording in product descriptions, and some Seller Aliases may have common ownership.” Judge Daniel responds that those claims do “not establish that these defendants should be joined on the off chance that one of these situations apply.” Plus, Judge Daniel asks: if the defendants are copyists, aren’t likely independently copying each other or some third party?

Judge Daniel then drops the hammer on this case:

Contrary to the plaintiff’s suggestion, the Court has no discretion to bypass the standards set forth in Rule 20. I will not exercise my discretion to allow joinder only to sever defendants later. The rule establishes the standard. The plaintiff must meet that standard. Once the plaintiff meets that standard, the Court may exercise its discretion and permit joinder. Because the plaintiff has not shown that “any right to relief is asserted against [the defendants] jointly, severally, or in the alternative with respect to or arising out of the same transaction, occurrence, or series of transactions or occurrences,” the Court is not in a position to exercise its discretion…

any suggestion that overlooking the requirements of Rule 20 serves judicial economy fails. The Court must still review infringement contentions as to each defendant, whether the defendants are joined in one case or sued individually. Because the Court does the same work, this does not improve efficiency. Experience has shown that allowing dozens and even hundreds of defendants to be joined in one case undermines judicial economy. In addition to evaluating the plaintiff’s evidence as to each defendant, the Court must keep track of each defendant’s filings. While true that many defendants default in Schedule A cases, there are times when multiple defendants appear, seek different relief, require multiple hearings on varying motions, have different dates, and so on. This creates friction within the case that complicates the “managing and structuring civil litigation for fair and efficient resolution of complex disputes.” In short, Schedule A cases can quickly become unwieldy. Therefore, even had the plaintiff satisfied Rule 20, I would not allow joinder because it would undermine the fair and efficient resolution of the case.

The latter point about judicial economy gets at the heart of how the SAD Scheme abuses the filing fee. By combining independent cases, a SAD Scheme plaintiff creates (in this case) 103 separate lawsuits that each require judicial attention, but without having overcome the gatekeeping function of the initial filing fee. As I’ve mentioned before, I estimated the SAD Scheme has been a wealth transfer from US taxpayers to rightsowners of a quarter-billion in saved filing fees. Judge Daniel is absolutely right to say that judicial discretion counsels AGAINST such undeserved wealth transfers.

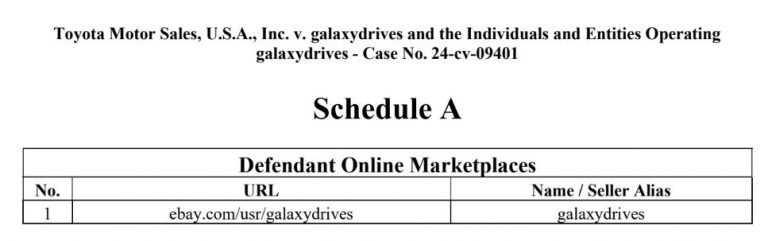

As for this case, in response to Judge Daniel’s joinder challenge, Toyota filed an amended complaint naming only “Galaxydrives” and related entities named on Schedule A:

In other words, Toyota shrunk this case so that it’s no longer a SAD Scheme. It seems like they are just trying to salvage the filing fee already paid in this case.

That’s progress, but will Toyota and the lawyers advising them be chastened enough to stop overreaching joinder claims in SAD Scheme cases? Or will Toyota, other rightsowners, and their lawyers keep filing more of the same, relying on the same defendant-unspecific and generic recitations of parallel infringement to support joinder, on the hope that the random wheel of judicial assignments is unlikely to land them in Judge Daniel’s courtroom again? We got a partial answer: since this ruling, Toyota already filed two more SAD Scheme cases (on Nov. 18 and Nov. 20, assigned to Judges Jenkins and Wood, respectively).

This is why it’s so important for other Northern District of Illinois judges to pay attention to Judge Daniel’s moves, especially because no defendants are around to raise joinder concerns or cite Judge Daniel during the ex parte TRO request. In contrast, if other judges follow Judge Daniel’s logic, then the SAD Scheme ought to quickly dry up.

This is why it’s so important for other Northern District of Illinois judges to pay attention to Judge Daniel’s moves, especially because no defendants are around to raise joinder concerns or cite Judge Daniel during the ex parte TRO request. In contrast, if other judges follow Judge Daniel’s logic, then the SAD Scheme ought to quickly dry up.

Case Citation: Toyota Motor Sales, USA, Inc. v. The Partnerships and Unincoporated Associations Identified on Schedule A, No. 24-cv-09401 (N.D. Ill. Nov. 18, 2024)

Prior Blog Posts on the SAD Scheme

- Another Judge Balks at SAD Scheme Joinder–Xie v. Annex A

- Will Judges Become More Skeptical of Joinder in SAD Scheme Cases?–Dongguan Juyuan v. Schedule A

- SAD Scheme Leads to Another Massively Disproportionate Asset Freeze–Powell v. Schedule A

- Misjoinder Dooms SAD Scheme Patent Case–Wang v. Schedule A Defendants

- Judge Hammers SEC for Lying to Get an Ex Parte TRO–SEC v. Digital Licensing

- Judge Reconsiders SAD Scheme Ruling Against Online Marketplaces–Squishmallows v. Alibaba

- N.D. Cal. Judge Pushes Back on Copyright SAD Scheme Cases–Viral DRM v. YouTube Schedule A Defendants

- A Judge Enumerates a SAD Scheme Plaintiff’s Multiple Abuses, But Still Won’t Award Sanctions–Jiangsu Huari Webbing Leather v. Schedule A Defendants

- Why Online Marketplaces Don’t Do More to Combat the SAD Scheme–Squishmallows v. Alibaba

- SAD Scheme Cases Are Always Troubling–Betty’s Best v. Schedule A Defendants

- Judge Pushes Back on SAD Scheme Sealing Requests

- Roblox Sanctioned for SAD Scheme Abuse–Roblox v. Schedule A Defendants

- Now Available: the Published Version of My SAD Scheme Article

- In a SAD Scheme Case, Court Rejects Injunction Over “Emoji” Trademark

- Schedule A (SAD Scheme) Plaintiff Sanctioned for “Fraud on the Court”–Xped v. Respect the Look

- My Comments to the USPTO About the SAD Scheme and Anticounterfeiting/Antipiracy Efforts

- My New Article on Abusive “Schedule A” IP Lawsuits Will Likely Leave You Angry

- If the Word “Emoji” is a Protectable Trademark, What Happens Next?–Emoji GmbH v. Schedule A Defendants

- My Declaration Identifying Emoji Co. GmbH as a Possible Trademark Troll

Pingback: Links for Week of November 29, 2024 – Cyberlaw Central()