NC Supreme Court Blesses Unilateral TOS Amendment to Add an Arbitration Clause–Canteen v. Charlotte Metro CU

In 2014, Phillips opened a checking account at Charlotte Metro Credit Union (CMCU) and “entered into a standard membership agreement.” The agreement included a unilateral amendments provision saying that CMCU “may change the terms of this Agreement. We will notify you of any change in the terms, rates, or fees as required by law.” Phillips agreed to accept electronic notices from CMCU.

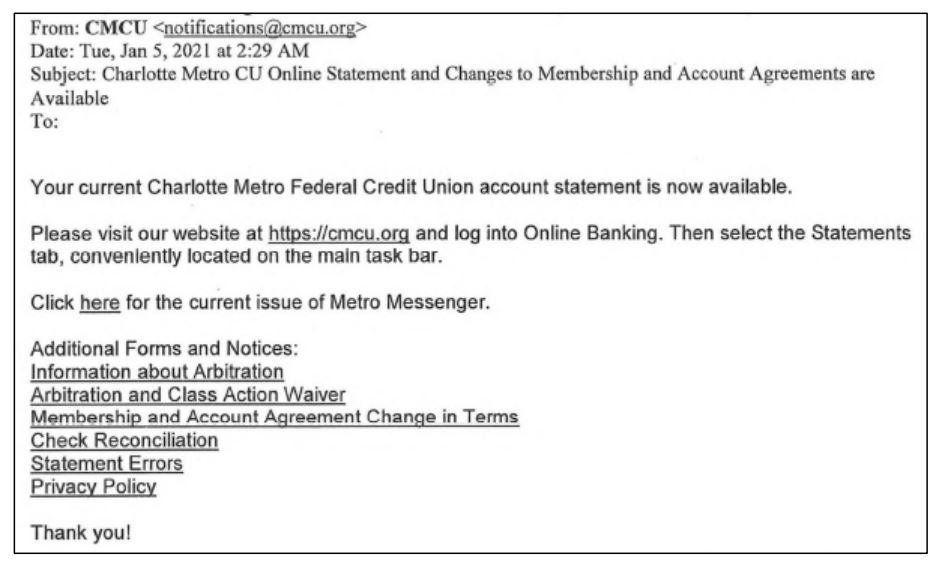

In January 2021, CMCU amended its membership agreement to add an arbitration clause and class action waiver. CMCU sent a January 5, 2021 email entitled “Charlotte Metro CU Online Statement and Changes to Membership and Account Agreements are Available.” This email contained links to the amendments:

Notice the absence of any call-to-action in the email text. If a recipient had clicked on the “Information about Arbitration” link, they would have seen the following text:

[The] Arbitration and Class Action Waiver provision will become effective on February 1, 2021. You do have until February 10, 2021 to exercise your right to opt-out of this provision (instructions on how to opt-out are included in the attached provision). However, if you don’t opt out of this provision, then your continued use or maintenance of your Charlotte Metro account will act as your consent to this new provision

Phillips didn’t opt-out of the amended provisions. The opinion references two other email notifications from CMCU on Feb. 2 and March 2, 2021 but doesn’t provide any details about those notifications.

__

The majority starts out with a broad principle:

when parties have mutually agreed to a unilateral change-of-terms provision, said provision “must be enforced as it is written,” subject to certain limitations. Contrary to plaintiff’s assertions, the traditional modification analysis which requires mutual assent and consideration does not apply to changes stemming from a valid unilateral change-of-terms provision in an existing contract.

The majority discusses two limitations on this principle. First, in a footnote, the majority says: “If a party’s amendment falls outside the “universe of terms” of the original agreement, it is no longer a permissible unilateral amendment and thus must comply with the traditional modification elements of offer, acceptance, and consideration.”

Second, the majority says the amendment must comply with the implied covenant of good faith and fair dealing. However, “if the original agreement includes any provisions relating to forums or methods for dispute resolution, then a modification to include an arbitration agreement is within the same universe of terms and therefore permissible under a change-of-terms provisions.” The majority explains:

Given the nature of the modern economy, change-of-terms provisions are a necessary and efficient way for companies to update contractual provisions without canceling accounts and renegotiating contractual terms every time modification may be required. At the same time, the implied covenant of good faith and fair dealing ensures that change-of-terms provisions do not provide carte blanche to parties seeking to modify agreements, as the changes must relate to the same universe of terms as the original agreement. Thus, we conclude that modifications made pursuant to change-of-terms provisions comply with the covenant of good faith and fair dealing if the changes reasonably relate to subjects discussed and reasonably anticipated in the original agreement.

The majority repeatedly relies on the phrase “universe of terms,” but what does it mean exactly? The majority doesn’t define it. Surely the phrase prevents amendments that include clauses that consumers would never anticipate, such as a new provision that would require the consumer to assign custody of their children to the vendor. Nevertheless, the majority takes a pretty expansive view of what’s in the “universe” of old terms. The majority is satisfied that the prior choice-of-law clause anticipated the arbitration clause, even though there is a pretty big difference between court adjudication and private adjudication. At the same time, the majority never explains (despite the dissent’s objection) how the class action waiver was anticipated by the prior terms. 🤷♂️

The majority also invokes “the nature of the modern economy” as a reason to deviate from traditional contract amendment requirements. The majority references the invisible hand of the marketplace:

While lay consumers may not understand every legal intricacy involved in the contractual process with companies, the market provides a way for consumers to respond to policies with which they disagree. As needs arise, competitor companies can provide alternatives for consumers, forcing improvements or updates to products or services, including terms to satisfy consumers’ desires.

I’m a big fan of marketplace competition as a disciplining force. However, banks intentionally make it hard for consumers to switch, such as by encouraging or requiring direct deposits so that bank switching requires multiple steps at multiple institutions. Unsurprisingly, consumers rarely switch banks. One survey indicated that consumers have had their checking and savings accounts for on average 17 years each. (However, I note some chatter that bank switching is rising).

In support of its “modern economy” point, the majority cites a 2013 article that DuckDuckGo saw a 50% boost in traffic after it was revealed that NSA had direct access to other search servers. Ha ha ha. Again, I strongly believe in the power of competitive forces in the search industry. However, the majority’s analogy is not persuasive. Switching between search engines is trivially easy (it requires a single click) compared to switching banks (a complex, baroque, time-consuming, heavily regulated, and bureaucratic process); and the stakes are a lot higher with a bank account (e.g., the risk of losing money) than the possibility that NSA might be snooping individual keyword search queries. As exemplars of marketplace competitive dynamics, bank accounts and keyword search queries are apples-and-oranges. More importantly, DuckDuckGo currently has about a 0.5% share of the search market 11 years after the 50% boost cited by the majority, so this isn’t exactly a great case study of the power of consumer switching.

Phillips also argued that the unilateral amendment right made the contract illusory, an argument that succeeded in the Harris v. Blockbuster case I have taught for about 15 years (remarkably uncited by both the majority and dissent). The majority works around this too, saying that CMCU’s amendment was constrained by the fact the amendment clause said “[e]xcept as prohibited by applicable law,” and the applicable law is the good faith and fair dealing covenant that the court just said was satisfied.

(To be clear, a contract phrase saying “except as prohibited by applicable law” should be unnecessary. Applicable law always overrides any contract terms. Yet, to the majority, this truism acted like magic words).

Finally, Phillips argued that she never assented to the arbitration clause. (As I noted, the email notice didn’t contain a call-to-action, let alone a mechanism for acceptance). The majority disagrees because Phillips initially assented to the unilateral amendment clause, making further mutual assent unnecessary.

The majority summarizes its conclusions:

Change-of-terms provisions permit unilateral amendments to a contract so long as the changes reasonably relate back to the universe of terms discussed and anticipated in the original contract. Here, the Arbitration Amendment was within the universe of terms of the contract between the parties, and thus complies with the implied covenant of good faith and fair dealing and does not render the contract illusory.

__

(Note: The NC Supreme Court consists of partisan elected judges, and the Republicans have a 5-2 majority. Partisan elections are generally a bad way of staffing the judiciary, because the partisanship distracts voters from assessing the key qualities of judges, plus judicial elections can distort how the judges vote (i.e., they worry about how rival candidates will spin the vote in the next election, or they may prioritize popular outcomes over the rule of law) and write their opinions (the opinions may play to the crowd or use opinions as an extension of their campaign material). Indeed, the only likely reason there are as many as 2 Democratic judges on the NC Supreme Court are because one won a 3-way race where the 2 Republican judicial candidates split the vote and the other was appointed by the Democratic governor. In any event, this opinion splits down partisan lines, something I’m guessing happens regularly with the NC Supreme Court.)

__

The two “liberal” justices dissented. The dissent starts out:

Today’s decision upends what should be a level playing field between ordinary customers and commercial entities. It hurts consumers, unfairly favors sophisticated corporations, and abandons the scrutinous approach generally taken to agreements of adhesion like form consumer contracts. Charlotte Metro Credit Union (CMCU) while facing a class action lawsuit related to the alleged assessment of unlawful fees against its customers, unilaterally imposed new terms on its membership agreement with Pamela Phillips in an apparent attempt to retroactively insulate itself from the full consequences of those allegedly unlawful acts. Relying on a materially unrestrained modification provision in a consumer contract, CMCU single-handedly deprived Ms. Phillips of her constitutional right to a jury trial on her claims and the ability to defray the burden of vindicating that right through a class action. To make matters worse, the modification’s language—drafted and adopted by CMCU alone—left Ms. Phillips without an avenue to opt out of arbitration and the class action waiver.

The dissent objects to the contract’s illusory nature:

The unilateral modification provision in this case—allowing CMCU to modify any provisions at will and waive contract terms in its sole discretion—renders the terms of the arbitration and class action waiver amendment illusory. The majority simultaneously holds that: (1) Ms. Phillips contracted away all essential elements for modification, i.e., offer, assent, and new consideration, (2) the arbitration amendment was a “change” to existing terms—rather than an addition of new terms—because the underlying contract contained a forum selection clause; and (3) retroactively and prospectively restricting claims to arbitration satisfied the implied covenant of good faith and fair dealing because such action “fall[s] within the universe of terms included in the original agreement . . . [which] remedies any purported issues of illusoriness which may arise from a change-of-terms clause.” If this is so, CMCU remains free to single-handedly unbind itself from arbitrating anything at all.

In response to the dissent’s arguments, the majority says: “it appears that every user contract between consumers and major companies such as Apple, Facebook, and Amazon are illusory because they contain change-of-terms provisions alongside governing law and/or arbitration agreements…How would my dissenting colleague propose products and services be efficiently delivered if, under such a limited view of the modern market, consumer contracts had to be canceled and renegotiated with every necessary update, some of which benefit consumers?” I agree with this concern, but it seems like the majority ought to explain the criticality of “efficient delivery” and why venerable amendment formation procedures don’t facilitate it (the argument “consumer contracts had to be canceled and renegotiated with every necessary update” attacks a strawman–no one is arguing for contract cancellation to effectuate amendments…?).

__

Implications

It appears the majority would uphold the amendment even if CMCU hadn’t let consumers opt-out of arbitration or hadn’t provided adequate notice of the opt-out…? In other words, per the majority, the amendment worked because (1) the initial membership agreement mentioned the amendment process, and (2) CMCU followed those specified mechanics, so the opt-out appears to be irrelevant to the legal analysis. That question is ultimately moot in this case because Phillips didn’t opt-out; but if the amendment would have worked without the opt-out, then CMCU has a lot of freedom to impose overreaching amendment terms so long as they fit within the “universe” of TOS terms.

In my Internet Law course, I discuss some possible options for implementing amendments (assuming these steps are consistent with the amendment provisions in the initial TOS):

- Not consent = posting the amendments without notice

- Consent = mandatory clickthrough to the amendment

- Consent (probably) = form multiple contracts in parallel with each other

- Take your chances = provide notice & opt-out

Here, CMCU took its chances and got its desired outcome. Not every court will be as forgiving.

Although the majority cuts numerous analytical corners, I’m strongly considering replacing the Blockbuster case in my casebook with this opinion.

Case citation: Canteen v. Charlotte Metro Credit Union, 2024 WL 2338525 (N.C. Sup. Ct. May 23, 2024)