California Tells Businesses: Stop Trying To Ban Consumer Reviews (Forbes Cross-Post)

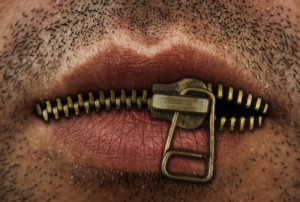

Photo credit: man’s mouth with bronze or gold metal zipper // ShutterStock

The new law says that a consumer contract “may not include a provision waiving the consumer’s right to make any statement regarding the seller or lessor or its employees or agents, or concerning the goods or services.” Any contract terms violating this provision are void. Simply including a prohibited clause in a contract, even if the business never enforces it, or threatening to enforce such a clause can lead to a penalty of up to $2,500 (up to $10,000 if the violation is willful). The penalties may be financially modest, but any California business foolish enough to take an anti-review contract to court will end up writing a check to their customers.

Instead of telling consumers they can’t review the businesses, some businesses are imposing financial penalties on consumers for writing negative reviews. I recently wrote about a New York hotel’s contract that fined customers $500 if they, or their wedding guests, posted negative online reviews. Disputes over fines will rarely end up in court because the hotel simply deducted the fine from the customer’s security deposit. Or other businesses, such as KlearGear, have filed negative credit reports against consumers who didn’t pay the fine. A consumer could challenge the security deposit deduction or negative credit report in court, but few will.

The statute tries to address the fining tactic by saying it’s unlawful to “penalize a consumer for making any statement protected under this section.” The statute doesn’t define what statements are “protected under this section,” so I’m not sure how courts will interpret the provision. The legislative history expressly references the KlearGear situation, so I anticipate the statute will cover fines against customers for writing negative online reviews.

We’ve also seen businesses use intellectual property claims to inhibit or discourage consumer reviews. The most notorious was the scheme by Medical Justice that helped doctors get their patients to assign the copyright in unwritten reviews. Unfortunately, the statute doesn’t directly address this situation, and arguably these IP-based tactics don’t constitute “waivers” prohibited by the statute. Perhaps courts will nevertheless interpret the statute to ban these abusive practices; otherwise, I fear we’ll see more IP-based anti-review shenanigans following this law.

If you’re responsible for your business’ contract with consumers, today’s a good day to review the contract and confirm that you don’t have any language that might be interpreted as a restriction on your customers’ ability to review your business. There are so many better ways to handle consumer reviews.

[Note: the press coverage about the bill’s passage has occasionally been confused because the legislature substantially amended it between introduction and passage and the coverage mistakenly addresses the initial bill version, not the bill as passed. Initially the bill would have allowed consumers to waive their review rights if the waiver were sufficiently well-informed; the final bill eliminates that option.]